Want to start the validation process to reduce debt?

Ever wondered what happens after you send those validation letters to start the process of removing your debt?

How Long Does a Creditor or Collector Have to Reply?

The creditor or collector has 30 days to respond and prove that your debt is valid. But what if they don't reply within that time frame?

In that case you actually win by default through something called 'tacit acquiescence'.

Now, it's pretty unusual for a creditor or collector to stay completely silent because they know that silence means they automatically lose the case. So, most of them will respond in some way. The question is, what will their response be?

Here's What a Lender Will Usually Do In Response to Your Letter

(A) They may ask for an additional 30 days by replying.

(B) They might send you a copy or a certified copy of the proof. However, it's important to remember that this doesn't prove that the original wet-ink signature is valid. We need proper validation, not just verification.

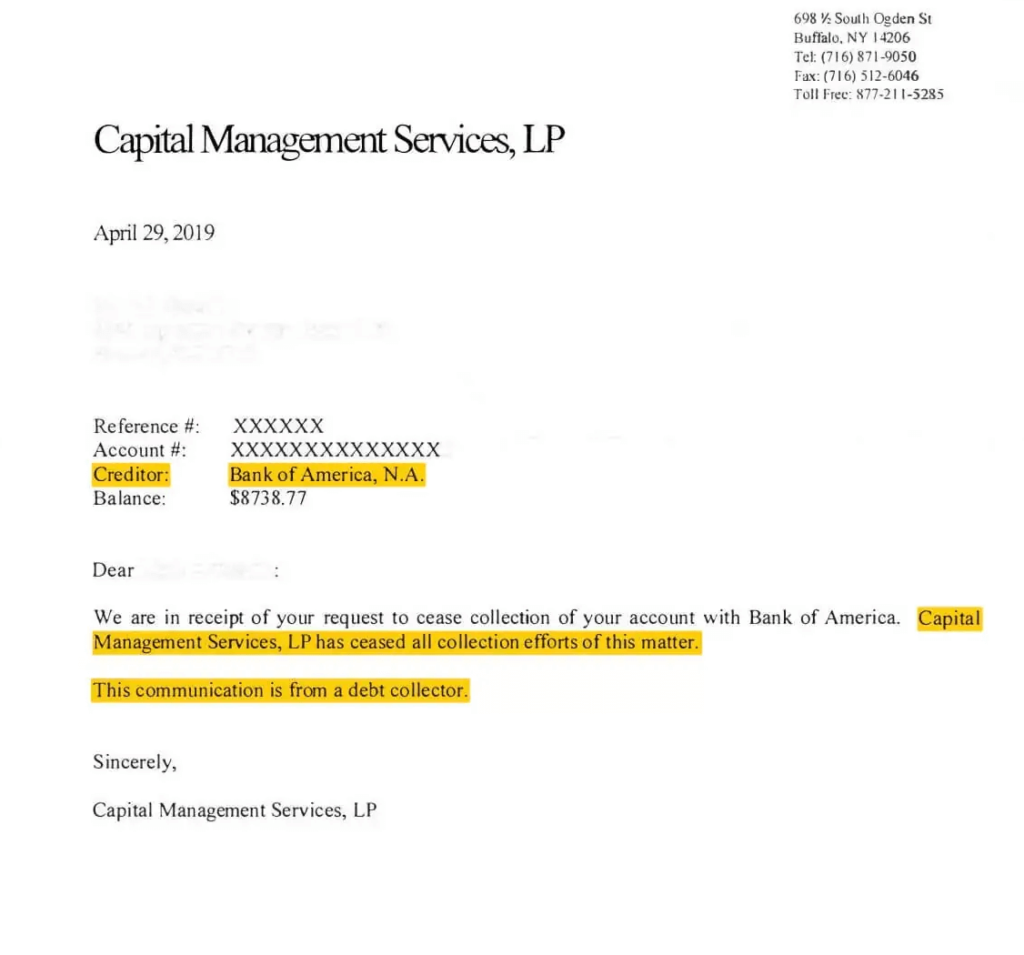

(C) They could send a confirmation letter stating that you no longer owe anything. (This is the best case scenario as seen in the example below).

Generally, smaller debts are easier and quicker to remove.

What's the First Step of the Validation Process?

One of the first things you should do is find out who the current creditor is. This will help you determine if you have a valid claim to remove it. If the original creditor still owns the debt and hasn't sold it, they have a rightful claim to it.

However, here's the thing: Most of the time, the original wet-ink signature note has already been sold, which means they can't prove its validity. In such cases, they might try to buy time, give in, or put up a fight.

You're In the Best Position to Erase Your Debt If...

If your debt has been sold or is in collections, you have a strong case for removing it. Debt buyers often lack accurate information about the debts they own, and they might even try to collect the wrong amount or from people with similar names who don't actually owe anything.

Here's an Important Tip Regarding Debt Validation:

If you've received the first collection notice, act quickly. 'Tacit acquiescence' works both ways. If you don't question the validity or request the name and address of the original creditor within 30 days of receiving the first collection letter, the agency can assume it's valid and continue their collection efforts. At that point, they can use all legal collection methods.

Isn't it time you learned the truth and freed yourself from the burden of debt?

The Next Step to Take

If you haven't done so already - you can Click Here to Watch Our FREE Debt Removal Workshop. If you're drowning in bills and want to learn the removal process, get the Debt Removal Secrets program for a way to erase the debt for good and STOP collectors and creditors in their tracks. Our proven method works for all types of unsecured debt including: medical bills, credit cards, loans, bankruptcies, and even student loans! Don't wait - we can help you start erasing that debt TODAY!