Wondering how to beat debt collectors and stop them from calling you?

Don't worry, we can help. Here's what you can do to handle the situation like a pro...

How to Stop Debt Collectors Cold

First, you may want to send debt collectors correspondence by mail instead of picking up their calls. However, if you do answer the phone, refrain from giving away any personal information except finding out the collector's name, company name, phone number, and address. Do not confirm if the information they have about you is correct as it might work against you. Do not talk about the debt. Disclosing any incorrect information or saying anything inappropriate might signal a red flag that they are scammers.

More Tips When Dealing With Debt Collectors

Make sure to keep note of the date and time of each call received. Debt collectors should not contact you before 8:00 a.m. and after 9:00 p.m., and should stop reaching out upon request through certified mail.

If you want to know how much the collector knows about the debt, you may inquire about the original creditor and if they hired an in-house collection department or a collection agency.

When Removing Debt - Timing Is Important

After the initial call, you can expect the collector to send you a written communication within five days. However, if you do not receive any, you should consider sending a debt dispute letter, also known as a verification letter. Do this within 30 days of the first contact. If you receive no response to your letter, the collector might assume the debt is valid and continue contacting you for repayment. Consider sending the letter by a method that allows you to track it (like certified mail) and keep a copy for your records.

What Happens After They Receive Your Letter

Once the collector has received the dispute letter, they must temporarily stop contacting you. The collector should resume contacting you only after sending you a validation letter that confirms the debt's validity.

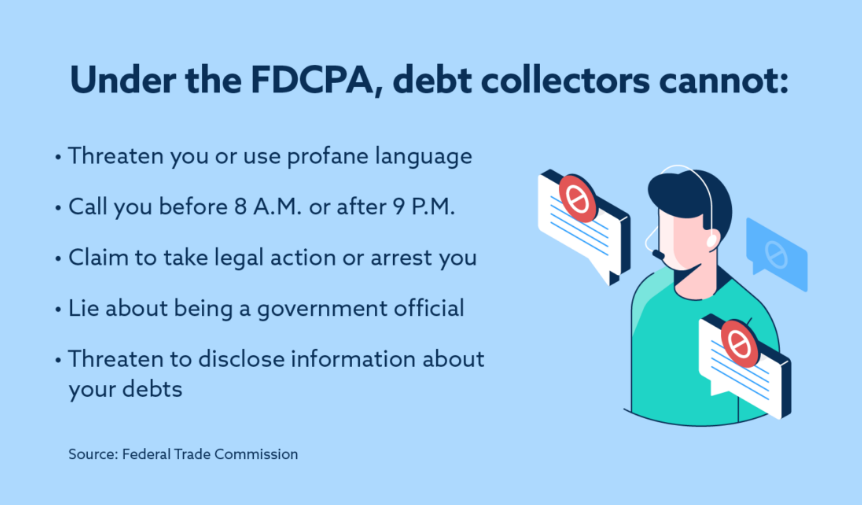

Uphold your rights under the Fair Debt Collection Practices Act (FDCPA) by familiarizing yourself with its guidelines. The FDCPA's enforcement is handled by the Federal Trade Commission and the Consumer Financial Protection Bureau. It applies to a broad range of consumer debts.

It is unlawful for debt collectors to call you at home during inconvenient hours, employ harassment tactics or threats of physical violence, use profane or abusive language, or disclose a borrower's debt collection attempts. They can't tell others about your debt collection efforts, claim a false debt, or misrepresent themselves as a law enforcement officer.

Does Debt Expire?

Yes. A time-barred debt is one that has exceeded the statute of limitations and is unenforceable. Each state has its own rule, generally ranging between three to ten years. For student loans, the debt may be up to 20 years old. Be mindful of not acknowledging the debt through writing because it may restart the time-barred debt timeline. Debt collectors could still try to collect a time-barred debt, even if the borrower is not legally required to pay it.

Debt collectors frequently attempt to collect extra fees or intimidate individuals into paying off debts they don't think they owe or that are beyond the statute of limitations. In such cases, there is legislation in place to protect you. Remember to use these laws to your advantage when facing debt collection issues. We'll show you exactly how to do this inside the Debt Removal Secrets program. Remember, knowledge is power, and together we can navigate this complex landscape and find true financial freedom!

Discover the Debt Removal Secrets program and take control of your financial future. If you're struggling with collections, our proven process will show you how to halt them in their tracks with speed and effectiveness.

The Next Step to Take

If you haven't done so already - you can Click Here to Watch Our FREE Debt Removal Workshop. If you're drowning in bills and want to learn the removal process, get the Debt Removal Secrets program for a way to erase the debt for good and STOP collectors and creditors in their tracks. Our proven method works for all types of unsecured debt including: medical bills, credit cards, loans, bankruptcies, and even student loans! Don't wait - we can help you start erasing that debt TODAY!